Highlights:

- Up to 12 loans can be underwritten delegated by Red Diamond and can contribute to our test cases.

- Any loan count over 12 will be a Manual Underwrite By Planet Home.

- 1003 Requirements - You can ignore section IV-Employment, Section V-Income, Section VI-Assets and Liabilities and Section VIII Declarations questions A-K, Planet Home Requires questions L to be completed

- No Appraisal

- Credit Report: Mortgage Credit Report or Mortgage Rating with Fico Scores for loan pricing. (How to pull a Mortgage Only Credit Report from Credit Plus - Click Here)

- Minimum Credit Score: 660 is the minimum Fico score for the non-qualifying streamline refinance. The reasoning is that the LLPA's from Planet Home is 2% below 660 which drives up the cost for a no-cost refinance too much. We can't roll anything in to the balance and we run out of premium to pay the LLPA.

- Below 660 - Consider doing a streamline with an appraisal and you can possibly roll in the closing costs and the LLPA.

- Minimum Loan Amount: $200,000 is the minimum because the closing costs are a percentage of the loan amount and we need to keep the total closing cost contribution at 1.75% or below.

- No Income Documentation: Not required to be filled out. No DTI calculated.

- No Employment Information: Not required to be filled out.

- No Asset Information: Not required to be filled out.

- Mortgagors: Borrowers must remain the same from the prior closing, or a borrower can be added. The exception is a divorcee or a death of a prior borrower.

- Primary Residence Only:(Utility bills are needed to confirm current residency)

- Pay history requirement: all payments must have been made on time 0*30, in the most recent six months and only 1 * 30 in the prior 6 months. This will come from the Mortgage Credit Report.

- Seasoning: The borrower must have made six payments on the mortgage that is being refinanced & at least six full months have passed since the first payment due date of the Mortgage; and at least 210 days have passed since the closing date; and if the loan was assumed the borrower must have made six payments.

- Net Tangible Benefit: This test must be met...at least a 1/2 a point decline in the rate for a fixed rate streamline.

- Funds to Close: Funds to close do not need to be verified if the amount of funds to close is less than the total of the new Mortgage payment. We expect the borrower to bring to closing an amount less than their new mortgage payment, but we do expect them to bring an amount close to their new mortgage payment to reduce the amount of lender contribution that is financed with a higher interest rate.

- Funds to Close - Escrow Balances: We are making available a zero interest, unsecured lien for the borrower to take out at closing for the amount of their escrow balance in there old loan. They can pay off that lien when they receive their escrow refund. This avoids higher interest rates to cover lender credits. See details below.

Additional Highlights:

- New Loan Amount Calculation: Outstanding principal balance, plus interest from the payoff, plus MIP on the new loan, less any UFMIP refund.

- Maximum CLTV: There is no maximum CLTV.

- MIP Calculations: To calculate the MIP, FHA uses the original value of the property to calculate the LTV .

Docs Needed From the Borrower:

- Homeonwers Insurance

- Current Mortgage Statement

- Utility Bill - current showing their primary residence

- Copy of their current Note and Survey from their old loan. (The note reflects the rate on the old loan to calculate the net tangible benefit is met. Also, the note reflects the original borrowers on the loan and the note date for MIP refund purposes.)

Docs Not Needed:

- Recommendation: Do not use your online application. It will only confuse the borrower. Most is not needed.

- No 4506T

- No AUS

- No Income Docs

- No Asset Docs

- No DTI calculation

- No Employment Information

- No Reserve requirement on a streamline

LO Steps:

- Don't use the Red Diamond online application. It will confuse the borrowers. Most is not needed.

- Do input the phone application info into the standard application from Encompass. Sections IV, V, VI, are not applicable. VIII-Declarations are required, especially Question L.

- Pull a Mortgage Only Credit Report through Encompass from Credit Plus/change the drop down - click here with 3 Fico Scores (Fico required for pricing the loan.)

- 660 Minimum Fico Required for Closing Cost Help, See Planet Home Pricing Adjustments for FHA Loans.

- Don't ask for income docs

- No Employment information is required

- No change to the borrowers

- Do complete the Present vs. Proposed housing expense on the application

- Just ask for those docs listed from the borrower to your left.

- Verify a clean payment history, no lates in the past six months and a max of 1 30 day late in the prior six months.

- Verify the mortgage seasoning has been met. See above.

- Send the request through Encompass for Survey, Homeowners, Utility Bill & Note for existing lien.

- Request through Encompass the eConsent.

LO & Borrower Conversation Topics:

- Borrower Summary Origination:

- Do get a two year history of residency. This may help with the seasoning requirement.

- Order Mortgage Only Report through Encompass - change the drop down from Consumer Credit to Mortgage Credit. See Credit Plus info here.

- 1003 Page 1:

- Complete basic property info and Borrower info, including mailing address.

- Skip Employment Info

- 1003 Page 2:

- Skip income and assets V & VI

- 1003 Page 3:

- Estimate the Escrow Subordinate Lien for the processor

- Gather the declarations

- Escrows are required on all loans

- Go over the zero interest unsecured escrow lien with the borrower. RDHL will execute the unsecured lien documents at closing and will fund the amount of the escrow balance from their old loan at closing.

- Closing costs are paid by the Red Diamond. See the Note Here

- MIP is required on the new loan at the standard FHA MIP schedule.

- Net tangible benefit is required, 1/2 point minimum reduction to the rate

- No change to the borrowers from the old loan

- Max term for a streamline: 15 & 30 year fixed are all that are available from Planet Home.

- Discuss the pay history if it's an issue from the Mortgage Credit Report

- Discuss seasoning if it's an issue

- Do Complete the Present vs. Proposed Housing Expense on the 1003 so we can ensure the net tangible benefit.

Processor Steps

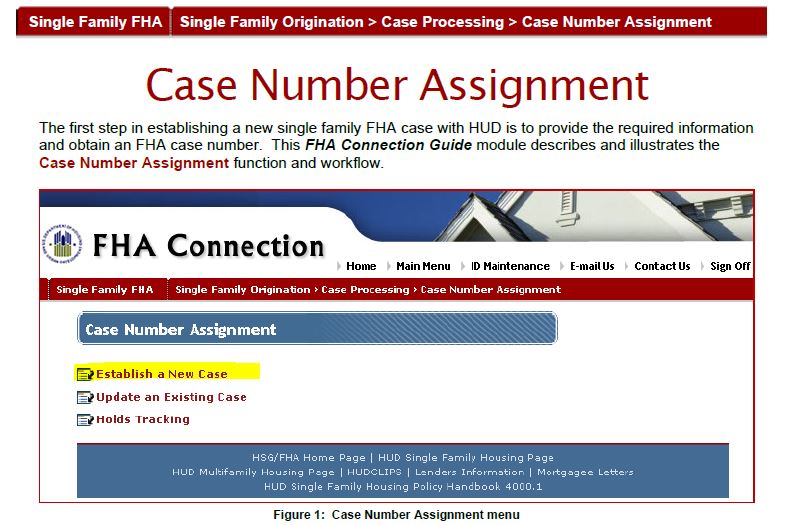

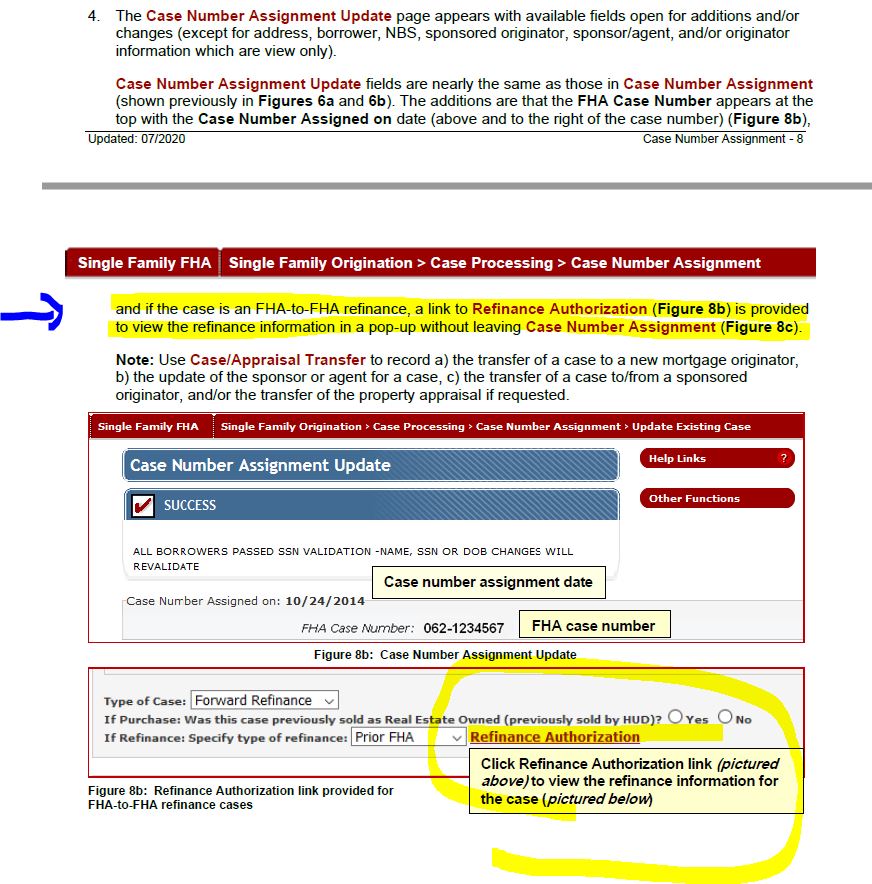

- Pull Case # on the loan - how to order a case # - click here

- Order the Payoff statement up front

- Order Title work quickly

- LDP/SAM: All parties to the transaction must be checked against these databases

- Loan Amount calculation: UPB + interest due on the payoff + MIP MIP on the new loan - any MIP refund from the old loan.

- No closing costs can be rolled into the new loan.

- The borrower's new escrow balance and account are funded by a zero interest unsecured note from Red Diamond, click here for a copy of the note.

- Unsecured Lien Payback: The borrower will endorse the escrow refund check over to Red Diamond Home Loans upon receipt. Those instructions are below.

- All allowable closing costs are paid by Red Diamond. This includes Title, Settlement, Doc-Prep, Recording etc. The only fee that can be rolled into the loan is prepaid interest.

- The borrower will bring an amount up to but not exceeding their new payment to the closing. (They will skip a payment.)

- Verify payment history is acceptable.

- Verify loan seasoning is acceptable.

- Our Non-Delegated investor is Planet Home. Submit the file to Planet Home with a all required documents. Mike Rogers will direct the submission.

Here is a copy of the unsecured note the borrower will sign for the escrow funds.

Here is a picture of how the borrower should endorse the escrow refund check.

Underwriting Guidelines & Matrix - Planet Home's FHA Streamline Refinance Program

Planet Home's FHA ID: 27128-00009

To Handle Closing Costs:

- Max Loan Amount: No additional funds can be added to the borrower's loan on a Streamline Refinance, except for prepaid interest from the payoff and the new Upfront MIP. The MIP Refund will be deducted from the loan amount.

- Cash At Closing: The borrower's cash to close is limited to no more than the amount of the new payment on the new loan. The borrower should expect to bring cash to closing because there will be an escrow shortage on the new loan vs. the old loan. Skipping a payment will create 1 month of shortage and any other escrow shortage will need to be funded with the borrowers payment at closing.

- Premium Pricing: Red Diamond will use premium pricing for the closing costs. The amount of lender credit needs to be limited. We cannot afford to pay an unlimited amount of closing costs.

Minimum Loan Terms:

- Minimum Loan Amount: $200,000 will be the minimum loan amount. This will keep the closing cost contribution at a reasonable percentage.

- Minimum Credit Score: 660 will be the minimum credit score for this program. This will keep the LLPA at a reasonable amount.

- Unsecured Note to fund the new escrow account (click here for the note): Red Diamond will use an unsecured lien (See the Note Below) for the amount of the escrow balance from the old loan being paid off. This unsecured lien will be signed for at closing by the borrower and the funds will be delivered to the Title Company by Red Diamond to fund this unsecured subordinate lien.

Commission hold-back for the Unsecured Lien Funds:

- LO Commissions: For loans using this unsecured lien, the commissions will not be paid until the unsecured note is paid off. The borrower should receive these funds within 30 days of the loan payoff and will immediately need to send the Escrow Refund Check to Red Diamond.

How to handle the Escrow Refund Check:

- Endorsing The Escrow Refund Check: The borrower will be able to endorse the escrow refund check they receive from their old servicing company.

How To Endorse The Check To Red Diamond Home Loans:

- To do this they need to 1. SIGN THE CHECK, as they would any check they were going to deposit the check. (THEY CANNOT WRITE FOR DEPOSIT ONLY ON IT)

- Then they need to 2. print their name underneath it, followed by Deposited to Red Diamond Home Loans For Deposit Only.

- Depositing the Escrow Refund Check: As long as the endorsement is exactly as is outlined above we can deposit the account and disburse the commission.

Escrow Refund:

- Make sure the escrow refund is received in the exact format outlined above so the funds can be deposited in the Red Diamond account and the unsecured lien can be cancelled and the commission for the loan can be paid.

Guides and Other Info/Links:

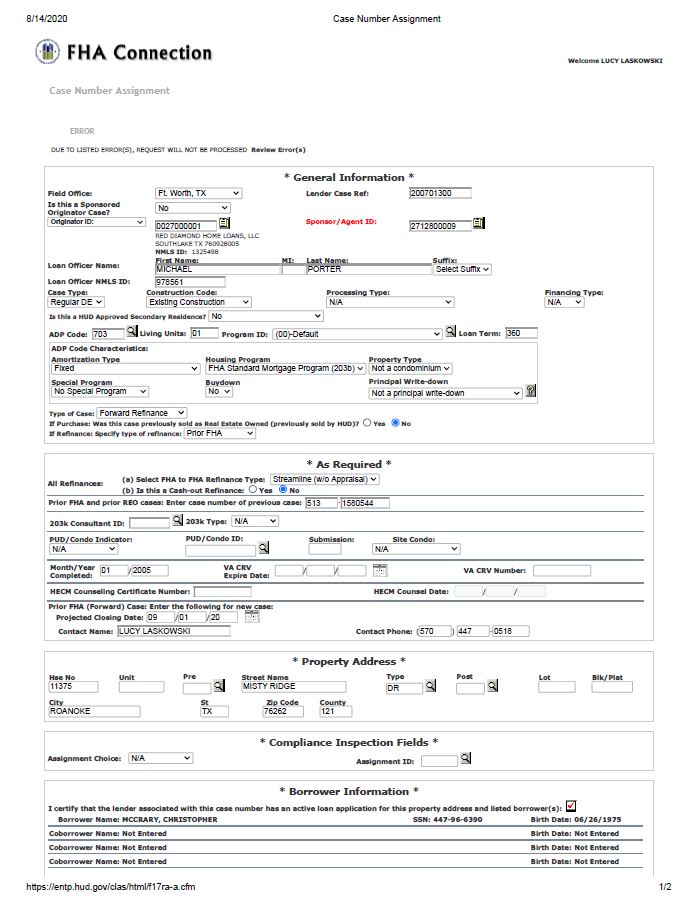

Here is a Case Number Assignment Form as an example:

Case Query Results Example:

MIP Refund Chart from HUD's 4000.1